Portfolio Overview

I started tracking and building this moonshot portfolio in June 2025, focusing on high-conviction biotech, semiconductor, and select tech stocks. Despite volatility in these growth areas, the portfolio has shown solid performance with disciplined buying, profit taking, and risk management.

Starting value: June 2025

Current total gain (realized + unrealized): Approximately +15.75% as of September 26, 2025

Market Context

The past two months since the last update have exhibited notable volatility, particularly in the biotech and semiconductor sectors. Despite temporary pullbacks, my moonshot portfolio held up well due to tactical purchases, profit-taking, and strong risk management. Earnings reactions in Qualcomm and STMicroelectronics provided buying opportunities, while biotech sectors showed some weakness.

Portfolio Moves & Tactics

Recent Executed Trades

- CRNX (Crinetics): Represented 38% of portfolio heading into September 26’s gain of 27%. After taking profits by selling about 22% of the position at prices $43.88 and $46, CRNX remains the largest holding at approximately 34%.

- QCOM (Qualcomm): Added ~2.5% of portfolio August 5 post earnings at $146, now up 16%.

- VKTX (Viking): Bought 10% overall starting July, holding near cost with minor unrealized loss.

- VNET: Small stable position at 2.4%, up 56.7%.

- STM (STMicroelectronics): Roughly 8% of portfolio, with 10% gains following post-earnings weakness buying.

- AEVA Technologies: Small 1.1% position near cost.

- AI (C3.ai): Speculative ~0.9% holding bought August 8, down 21.7%, classified in the Technology Services sector (packaged software).

- Costco (COST): Acquired around 6% of the portfolio on September 26 using proceeds from CRNX profits, aimed at improving diversification and lowering portfolio concentration risk.

- Cash: Maintained about 35% for flexibility and new opportunities.

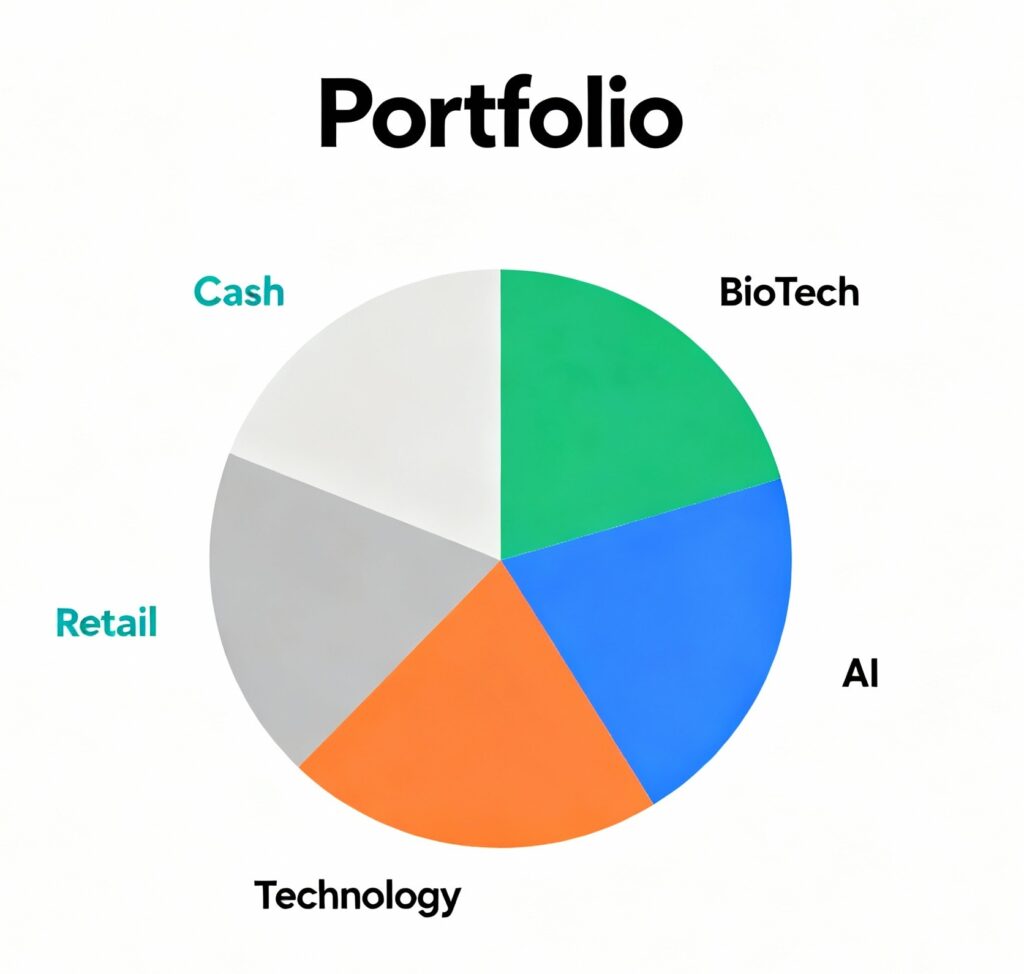

Current Portfolio Snapshot

| Ticker | Company | Sector | Approx. % of Portfolio | Avg. Cost | Current Price | Gain/Loss % | Notes |

|---|---|---|---|---|---|---|---|

| CRNX | Crinetics | Biotech | 33.7% | $31.86 | $44.91 | +40.96% | Largest holding, profit-taking |

| VKTX | Viking | Biotech | 10.2% | $26.86 | $25.26 | -5.96% | Near cost, awaiting catalysts |

| VNET | VNET Group | Data | 2.4% | $7.00 | $10.97 | +56.71% | Small, strong performer |

| STM | STMicroelectronics | Semiconductor | 8.1% | $25.36 | $27.97 | +10.29% | Added on earnings weakness |

| AEVA | AEVA Technologies | Lidar | 1.1% | $15.40 | $15.26 | -0.91% | Small position |

| QCOM | Qualcomm | Semiconductor | 2.5% | $146.00 | $169.47 | +16.08% | Bought post-earnings dip |

| AI | C3.ai, Inc | Technology Services sector | 0.9% | $22.20 | $17.39 | -21.67% | Small speculative |

| COST | Costco Wholesale | Retail | 6% | $923.70 | $924.36 | +0.07% | Diversification trade |

| SLDP | Solid Power | Battery | 0% | $2.20 | $3.78 | 0% | Target 80 shares, limit order pending |

| RNA | Avidity Biosciences | Biotech | 0% | $28.00 | $42.05 | 0% | Target 9 shares, limit order pending |

| Cash | — | — | ~35% | — | — | — | Held for flexibility |

Total Portfolio Gain (Realized + Unrealized): Approximately +15.75%

Lessons & Outlook

- Tactical buys on CRNX before FDA news and STM after earnings paid off, validated by strong gains.

- Taking profits on CRNX allowed a timely diversification trade into Costco, balancing growth and risk.

- Small exposures to speculative names like AI remain sized to limit risk.

- Cash remains significant (~35%) to remain nimble for upcoming opportunities.

- Continued patience with VKTX and AEVA as biotech/Lidar volatility plays out.

- Limit orders on SLDP and RNA remain active for potential entry points.

Next Steps & Watchlist

- Watch CRNX catalysts closely; maintain prudent exposure.

- Taking profit from VNET as it has gained 56%

- Monitor biotech names VKTX and VEVA for accumulation opportunities amid volatility.

- Evaluate limit orders on SLDP and RNA regularly.

- Deploy cash thoughtfully into new high-conviction ideas while preserving allocation discipline.

Disclaimer: This update is for educational and informational purposes only and does not constitute investment advice. It is not a recommendation to buy or sell any securities. Readers should perform their own research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.