The moonshot portfolio continued its strong performance through October, pushing total gains to approximately 20.8% since the portfolio’s inception in June 2025. This growth represents a roughly 5% increase over the 15.75% reported at the end of September. The increase reflects disciplined profit-taking across multiple high-conviction holdings, including partial sales in SLDP, VNET, and VKTX, alongside new position additions in software and fintech names. Note that recent cash additions have diluted the percentage performance somewhat, which is typical as new capital deploys and requires time to appreciate.

Portfolio Snapshot

| Ticker | Company Name | Sector | Approx. % of Portfolio | Avg. Cost | Current Price | Gain/Loss % |

|---|---|---|---|---|---|---|

| CRNX | Crinetics | Biotech | 36.7% | $33.21 | $43.50 | +31.0% |

| VKTX | Viking | Biotech | 9.6% | $26.42 | $38.08 | +44.1% |

| VNET | VNET Group | Data | 0.7% | $7.00 | $10.40 | +48.6% |

| STM | STMicroelectronics | Semiconductor | 8.3% | $25.26 | $24.47 | -3.1% |

| AEVA | Aeva Tech | Lidar | 1.1% | $15.40 | $16.34 | +6.1% |

| QCOM | Qualcomm | Semiconductor | 2.5% | $146.00 | $180.90 | +23.9% |

| AI | C3.ai | Technology Services | 0.8% | $22.20 | $17.58 | -20.8% |

| COST | Costco | Retail | 6.2% | $923.70 | $911.45 | -1.3% |

| TEAM | Atlassian | Software | 3.5% | $148.67 | $169.42 | +14.0% |

| SNWV | Sanuwave | Medical Devices | 1.0% | $30.55 | $28.94 | -5.3% |

| ROOT | Root Inc. | Fintech | 1.1% | $77.01 | $80.52 | +4.6% |

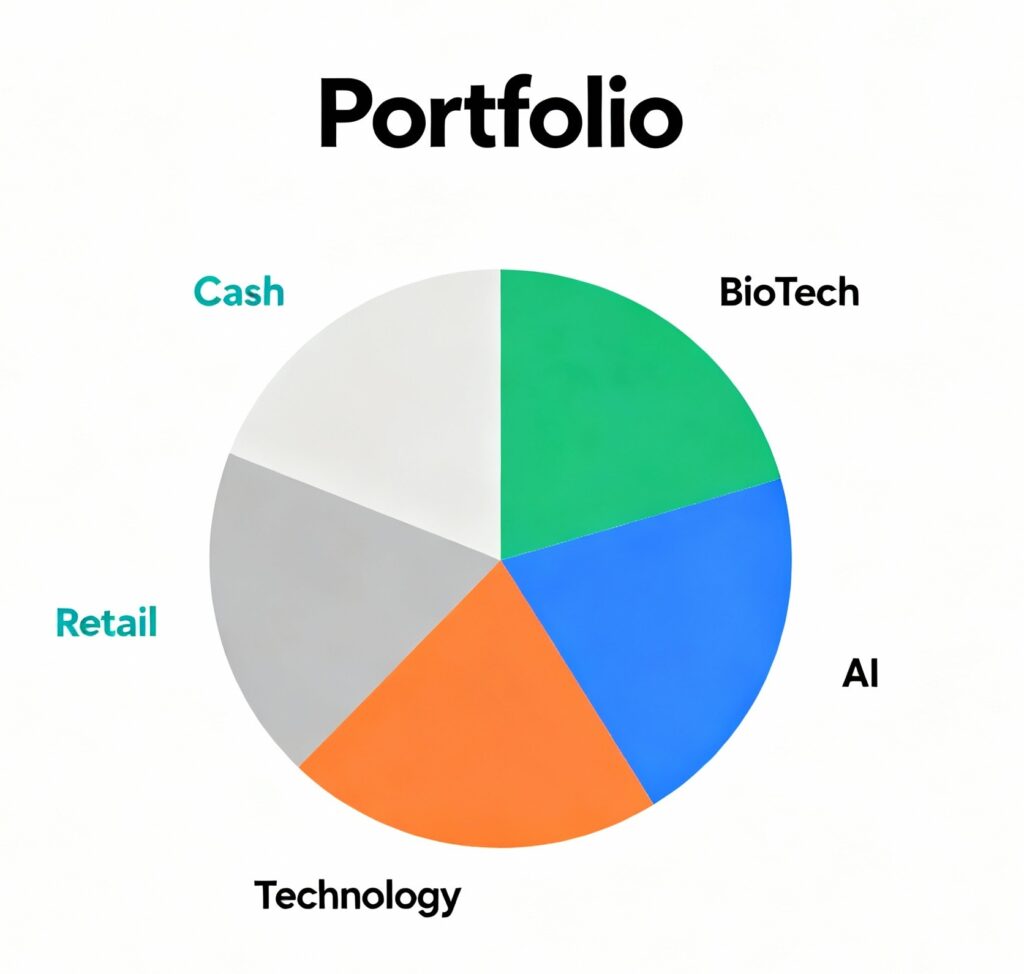

Cash now represents about 28.5% of the portfolio, a deliberate allocation reflecting proceeds from sales in SLDP, VNET, and VKTX to maintain flexibility for new opportunities.

Realized gains have grown to nearly 5% of the total portfolio, signaling successful trims on winners while maintaining core holdings for long-term growth.

Market Context & Portfolio Moves

October’s market environment was characterized by mixed signals across biotech, technology, and semiconductor sectors. Despite some sector volatility, the moonshot portfolio has benefited from tactical buying and selective profit-taking.

The sale of SLDP shares in tranches at $5.22, $6.90, and $6.45 was a highlight, locking in significant gains on a rapid appreciation from the initial $3.45 cost basis. Similarly, partial profit-taking in VNET and VKTX contributed meaningfully to realized gains without sacrificing core exposure.

New purchases in TEAM, ROOT, and SNWV broaden exposure in software and fintech, aligning with themes of innovation and growth that complement the biotech backbone.

Lessons Learned & Strategy Outlook

- Maintaining CRNX as the largest position has proven prudent, with shares up over 31% since purchase.

- Profit-taking in secondary holdings like VKTX and VNET has helped crystallize gains and provide cash for redeployment.

- The high cash allocation ensures nimbleness to seize potential moonshots in a volatile market.

- Smaller speculative positions such as AI and SNWV require continuous monitoring due to higher volatility.

- Balanced portfolio management—cutting winners, holding conviction names, and strategic additions—has yielded solid growth over four months.

The portfolio remains focused on disciplined growth through high-conviction moonshot investments, balancing tactical moves with a longer-term investment horizon.

Disclaimer: This update is for informational purposes only and does not constitute investment advice. Please perform your own research and consult with qualified professionals before making any investment decisions. Past performance does not guarantee future results.