Note: I am renaming my Moonshot Portfolio to the Satellite Portfolio going forward. The intent is shifting from more speculation to long-term, viable companies with strong moats, while still allowing for asymmetric upside.

Why the Name Change: From Moonshot to Satellite

The original idea behind the Moonshot Portfolio was to experiment with higher-risk, higher-reward ideas—small positions that could meaningfully move the needle if a few worked out.

As we enter the new year, my thinking has evolved.

This portfolio will now be called the Satellite Portfolio, designed to orbit around my core long-term holdings. The emphasis will be:

- Gradually building positions in durable businesses with strong competitive moats

- Lower turnover and less active trading

- Letting winners run longer instead of frequent trimming and re-adding

- Reducing exposure to the riskiest positions over time

Costco (COST) is the first clear example of this shift already reflected in the portfolio.

Performance Snapshot (18% Since June 2025)

I am satisfied with this result, especially given the relatively short time frame.

That said, I want to be very clear:

This performance does not indicate special skill.

The overall market strength during this period played a meaningful role in the outcome. A rising tide lifted many boats, including this one.

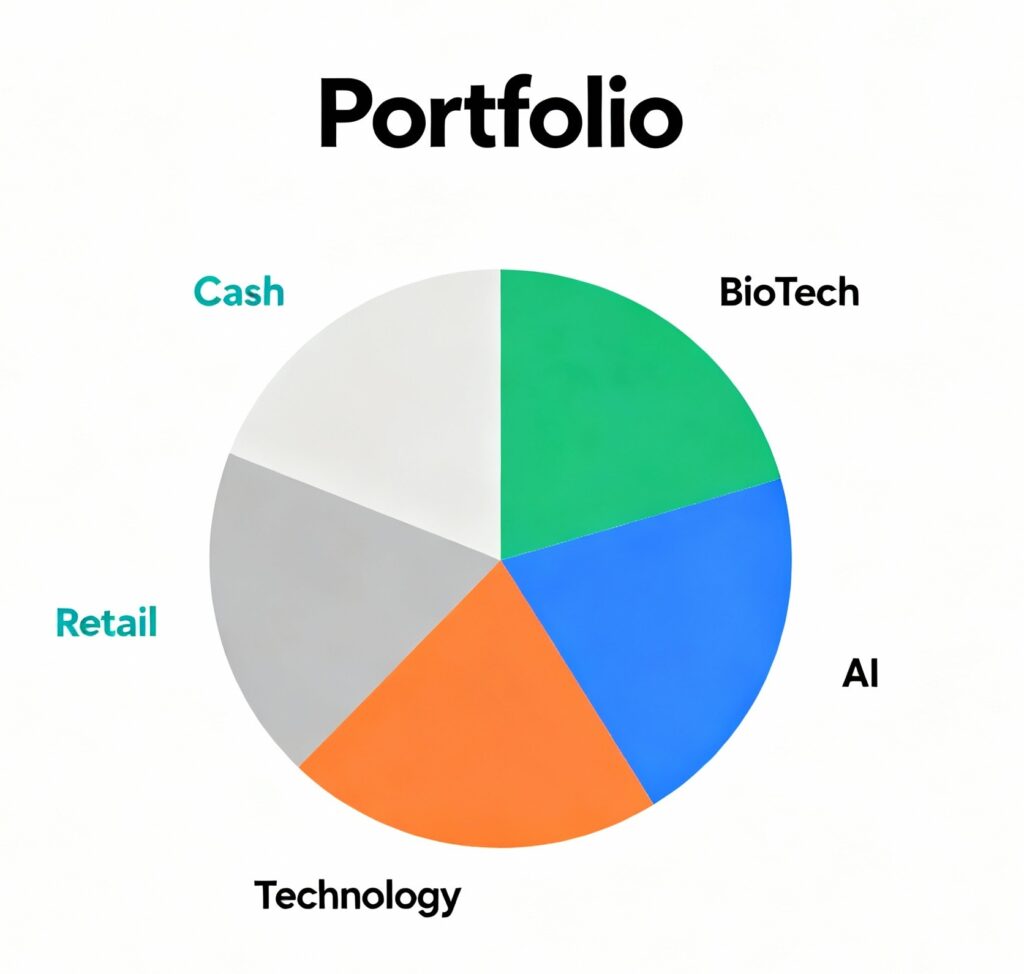

Current Holdings Snapshot as of 12/31/2025

Below is a percentage-based snapshot of the Satellite Portfolio. I am intentionally focusing on weights and percentage gains/losses, not dollar amounts, to reinforce long-term thinking and reduce short-term noise.

| Ticker | Company | Sector | Portfolio Weight | Gain / Loss % |

|---|---|---|---|---|

| CRNX | Crinetics | Biotech | 35.69% | +40.17% |

| COST | Costco | Consumer Defensive | 21.33% | -2.94% |

| VKTX | Viking | Biotech | 8.05% | +33.16% |

| STM | STMicroelectronics | Semiconductor | 8.02% | +2.69% |

| NOW | ServiceNow | Software | 4.74% | -11.45% |

| QCOM | Qualcomm | Semiconductor | 3.17% | +10.41% |

| TEAM | Atlassian | Software | 3.01% | +9.06% |

| SLDP | Solid Power | Battery Tech | 2.76% | -15.00% |

| SNWV | SNWV | Small Cap | 2.03% | +6.31% |

| VNET | VNET Group | Data / Infra | 1.31% | +9.16% |

| ROOT | Root | InsurTech | 0.89% | -6.21% |

| AEVA | Aeva Technologies | Lidar | 0.82% | -13.77% |

| AI | C3.ai | AI Software | 0.58% | -39.28% |

| Cash | — | — | 7.61% | — |

| Total Portfolio | — | — | 100% | +18.43% |

Current Structure & Observations

A few high-level observations from the current holdings:

- Concentration is emerging naturally, with Costco now representing a meaningful weight

- Biotech and speculative names (e.g., CRNX, VKTX, SLDP) still exist but will be evaluated more critically

- Cash remains intentionally available for patience and flexibility

- Some positions are down, which is expected in a satellite-style portfolio

Losses and volatility are not mistakes by default—they are the cost of optionality. The key is position sizing and time.

Philosophy Going Forward

1. Less Trading, More Letting Stocks Run

In the past, I tended to:

- Trim winners early

- Add and reduce positions frequently

- React too much to short-term price movement

Going forward, I plan to:

- Trade less

- Avoid constant tinkering

- Allow strong businesses the time they need to compound

2. Gradual Risk Reduction

I may reduce exposure to the riskiest names over the new year—not abruptly, but deliberately.

This is not about market timing. It is about aligning the portfolio with how I actually want to invest:

- Patient

- Low stress

- Long-term oriented

What This Portfolio Is (and Is Not)

This portfolio is:

- A satellite to my core assets

- An outlet for selective conviction

- A long-term experiment in ownership, not trading

This portfolio is not:

- A performance contest

- A day-trading vehicle

- A reflection of short-term skill

Closing Thoughts

An 18% gain in roughly half a year is a good outcome—but it is also a reminder of humility. Markets give and take.

The real goal of this Satellite Portfolio is not to chase excitement, but to:

Own fewer, better businesses — and give them time to work.

Future updates will focus less on short-term price changes and more on business quality, conviction, and portfolio behavior over time.

As always, this is a personal record, not advice.