The Movie Myth That Won’t Die

In Hollywood, going all-in is heroic. In The Big Short, Michael Burry bets billions against the housing bubble—and wins. In Wall Street, Bud Fox risks everything chasing the big score.

But in the real world, most people who “bet the farm” don’t make it to the credits. They go broke, lose confidence, and miss the slow, steady path to real wealth: staying solvent and sizing smart.

Why Going All-In is a Trap

- It feels bold—but it’s often impulsive, emotional, and unrepeatable.

- It rarely ends well. For every Burry, there are a thousand traders who didn’t survive long enough to be right.

- It breaks your edge. You stop thinking in probabilities and start chasing outcomes.

Real investing isn’t about bold moves—it’s about repeatable moves that keep you in the game.

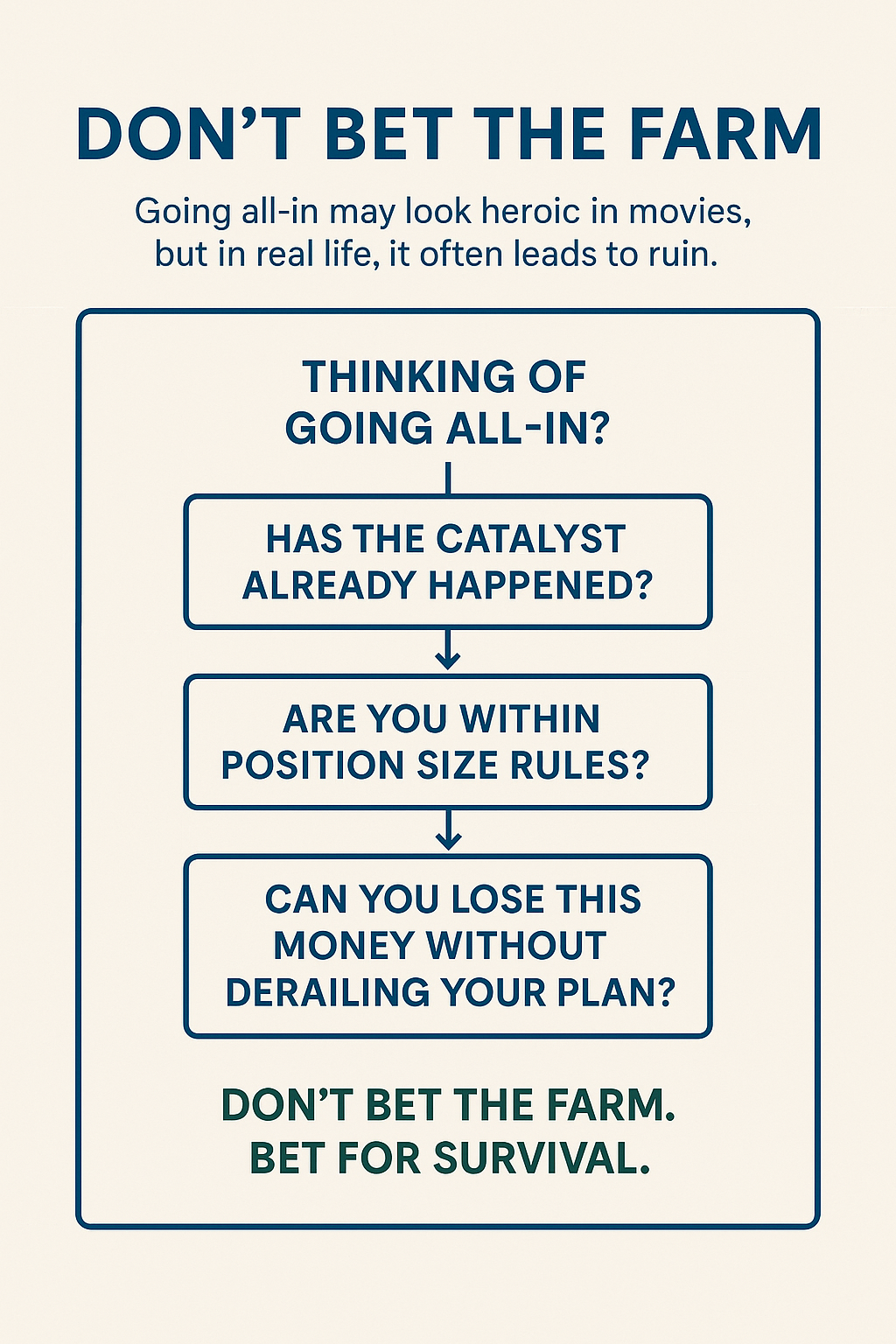

The 3-Question Solvency Test

Before you size up or make a high-conviction trade, ask yourself:

- Has the catalyst already happened?

If not, you’re trading a narrative—not reality. - Am I within my pre-set position size?

Doubling down before proof is a shortcut to regret. - Can I lose this capital and still execute my next trade?

If not, the position is too large.

What Real Investors Do

- They size to survive, not to score.

- They increase exposure only after positive catalysts.

- They see missed upside as acceptable—because staying solvent is the real win.

Closing Thought

Hero trades are great in movies. But if your goal is to build wealth over decades—not just look smart for a moment—you need a different mindset.

Don’t bet the farm. Bet to stay in the game. Because you only need to get rich once—and you can’t do that if you’ve wiped out your capital.